(LEAD) KRX unveils 4 new dividend indices

(ATTN: ADDS more details in paras 7-8)

SEOUL, Oct. 21 (Yonhap) -- South Korea's bourse operator on Tuesday unveiled a set of new indices that track high dividend-paying stocks, hoping that they will serve as key investment tools in the era of low market rates and low growth.

The four new indices -- the KOSPI high dividend index, the KRX high dividend index, the KOSPI dividend growth index and the KOSPI preferred share index -- track stocks paying high dividends, stocks with stable dividend growth and preferred shares, according to the Korea Exchange (KRX).

Usually, preferred stocks offer a higher dividend per share than common stocks because they do not come with voting rights and have low turnover rates.

"Our analysis shows that the new indices have outperformed other indices such as the KOSPI 200 over the past five years, and in particular, the KOSPI high dividend index turned out to have a dividend yield ratio of more than 4 percent annually," the bourse operator said in a statement.

The dividend yield ratio refers to a company's annual dividend payments per share divided by the share price, or the ratio of returns investors receive per share.

According to the KRX, the KOSPI dividend growth index is also estimated to have posted an annual return rate of 30 percent, far higher than the KOSPI 200 index's annual return of 8 percent.

The components of each index match the bourse's pre-set criteria, such as a three-year straight dividend payout, a market capitalization of 50 billion won or more, and a certain dividend payout ratio, according to the KRX.

The bourse operator said the new indices will debut on Monday, and be revamped every June, adding that more dividend indices will be developed in the future.

The unveiling of the new indices came amid a government push to encourage companies to increase their dividend payouts.

Finance Minister Choi Kyung-hwan, who took office in July, has berated the country's conglomerates for stocking up on cash and thereby disrupted the money flow into households that need to spend more to prop up domestic consumption.

Economic policymakers have been struggling to spur domestic spending that was crimped after the deadly passenger ferry sinking in April.

Local companies have been stingy in paying dividends, a key reason why South Korean stocks are undervalued. The latest data from the Korea Exchange show South Korea's dividend payout ratio at 22.4 percent, far below the average of 47.7 percent in other countries. The dividend yield ratio is 1.1 percent, compared with 2.7 percent overseas. The dividend yield ratio goes down as companies retain more cash.

The bourse operator also said earlier it would come up with a number of different incentives to induce companies to pay out more dividends.

"I hope new indices-linked products would help the country's capital market take a further leap," said KRX CEO and chairman Choi Kyoung-soo. "Increased dividend payouts would also help foster long-term investment."

sam@yna.co.kr

(END)

-

'Queen of Tears' weaves rich tapestry of Korean contemporary art

'Queen of Tears' weaves rich tapestry of Korean contemporary art -

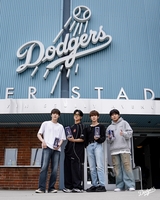

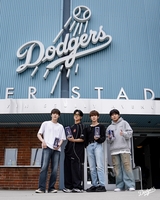

Ateez member Yunho throws first pitch at MLB match between Dodgers, Mets

Ateez member Yunho throws first pitch at MLB match between Dodgers, Mets -

N. Korea says Kim guided simulated nuclear counterattack drills for 1st time

N. Korea says Kim guided simulated nuclear counterattack drills for 1st time -

N. Korea calls envisioned U.S. aid to Ukraine 'hallucinogen'

N. Korea calls envisioned U.S. aid to Ukraine 'hallucinogen' -

N. Korea calls on party propaganda officials to work harder

N. Korea calls on party propaganda officials to work harder

-

'Queen of Tears' weaves rich tapestry of Korean contemporary art

'Queen of Tears' weaves rich tapestry of Korean contemporary art -

Experts see possibility of N.K. conducting nuclear test before U.S. presidential vote

Experts see possibility of N.K. conducting nuclear test before U.S. presidential vote -

Details of meeting between Yoon, opposition leader undecided: presidential office

Details of meeting between Yoon, opposition leader undecided: presidential office -

N. Korea says Kim guided simulated nuclear counterattack drills for 1st time

N. Korea says Kim guided simulated nuclear counterattack drills for 1st time -

Looming weekly closure of major hospitals feared to worsen medical service crisis

Looming weekly closure of major hospitals feared to worsen medical service crisis

-

S. Korea eliminated in Olympic football qualifiers as poor defense, undisciplined play prove costly

S. Korea eliminated in Olympic football qualifiers as poor defense, undisciplined play prove costly -

10-man S. Korea lose to Indonesia to miss out on Paris Olympic football qualification

10-man S. Korea lose to Indonesia to miss out on Paris Olympic football qualification -

(LEAD) 10-man S. Korea lose to Indonesia to miss out on Paris Olympic football qualification

(LEAD) 10-man S. Korea lose to Indonesia to miss out on Paris Olympic football qualification -

Indonesia coach left with mixed feelings after eliminating native S. Korea in Olympic football qualifiers

Indonesia coach left with mixed feelings after eliminating native S. Korea in Olympic football qualifiers -

ADOR CEO calls conflict with Hybe 'worst experience of my life'

ADOR CEO calls conflict with Hybe 'worst experience of my life'