Personal bailouts on rise as household debt grows

SEJONG, Nov. 27 (Yonhap) -- The number of filings for personal bailouts in South Korea rose 7.6 percent in the first 10 months of the year from a year earlier and may well reach a new record, an analysis of data indicated Thursday, in what market watchers see as a symptom of mounting household debts.

A total of 93,105 people sought a state-managed bailout during the January-October period, according to court records and financial sources.

The number has been increasing since 2010, from 46,972 that year to 65,171 in 2011 and 90,368 in 2012. It reached a record 105,885 in 2013, surpassing 100,000 for the first time. Market observers say that at current pace, this year may well become a new record.

The government-assisted personal bailout program, referred to as the individual rehabilitation program, is designed to give a second chance to people on the verge of insolvency by rearranging credit obligations and legal duties to write off their debts. People who have a stable source of income and assets, and have less than 1 billion won (US$902,500) in debt are eligible for the program.

On the other hand, those filing for personal bankruptcy fell 3.1 percent on-year to 45,767 over the same period as courts toughened the screening process for applicants.

Market watchers point to the rising household debt as the cause of the sharp rise in personal bailouts.

According to central bank data, South Korea's household debt reached a record 1,060 trillion won as of end-September, up 2.1 percent from 1,038.3 trillion won in June. Household debt has not dropped below 1,000 trillion since December last year, the first time when the figure exceeded the level.

Experts worry that the current low interest rate trend will not help cool down the growing household loans. The Bank of Korea reduced the key rate to a record low of 2 percent in October and is expected to make another cut in the near future.

The government's eased lending regulations, meant to revive the real estate market, also fueled household debts, they say.

A recent report released by the Organization for Economic Cooperation and Development (OECD) said South Korea's efforts to boost the housing market could lead to an increase in private sector debt, which would pose challenges for financial institutions and hurt private consumption.

brk@yna.co.kr

(END)

-

S. Korea marks 30th anniv. of Korean Pavilion at Venice Biennale with contemporary art

S. Korea marks 30th anniv. of Korean Pavilion at Venice Biennale with contemporary art -

Artist Lee Bae captures ethereal Korean aesthetics at Venice Biennale

Artist Lee Bae captures ethereal Korean aesthetics at Venice Biennale -

Ateez member Yunho throws first pitch at MLB match between Dodgers, Mets

Ateez member Yunho throws first pitch at MLB match between Dodgers, Mets -

Gov't likely to accept university chiefs' request to lower med school enrollment quota

Gov't likely to accept university chiefs' request to lower med school enrollment quota -

S. Korea supports resolution backing U.N. membership of Palestine

S. Korea supports resolution backing U.N. membership of Palestine

-

Artist Lee Bae captures ethereal Korean aesthetics at Venice Biennale

Artist Lee Bae captures ethereal Korean aesthetics at Venice Biennale -

S. Korea marks 30th anniv. of Korean Pavilion at Venice Biennale with contemporary art

S. Korea marks 30th anniv. of Korean Pavilion at Venice Biennale with contemporary art -

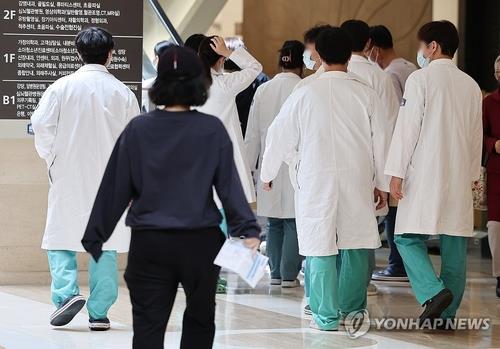

Gov't likely to accept university chiefs' request to lower med school enrollment quota

Gov't likely to accept university chiefs' request to lower med school enrollment quota -

Experts see possibility of N.K. conducting nuclear test before U.S. presidential vote

Experts see possibility of N.K. conducting nuclear test before U.S. presidential vote -

Details of meeting between Yoon, opposition leader undecided: presidential office

Details of meeting between Yoon, opposition leader undecided: presidential office

-

U.S. will take steps for three-way engagement on nuclear deterrence with S. Korea, Japan: Campbell

U.S. will take steps for three-way engagement on nuclear deterrence with S. Korea, Japan: Campbell -

(LEAD) Hybe to file complaint against sublabel executives over internal conflict

(LEAD) Hybe to file complaint against sublabel executives over internal conflict -

S. Korea reports highest suicide rate, ultra fine dust level among OECD nations: data

S. Korea reports highest suicide rate, ultra fine dust level among OECD nations: data -

Looming weekly closure of major hospitals feared to worsen medical service crisis

Looming weekly closure of major hospitals feared to worsen medical service crisis -

U.S. sent ATACMS missiles to Ukraine following Russia's use of N.K. missiles: White House

U.S. sent ATACMS missiles to Ukraine following Russia's use of N.K. missiles: White House