(LEAD) Seoul shares down 0.14 pct on overseas economic woes

(ATTN: ADDS bond yields at bottom)

SEOUL, Dec. 18 (Yonhap) -- South Korean stocks ended 0.14 percent lower Thursday as investors were shaken by an unfolding economic crisis in Russia. The South Korean won lost ground against the greenback.

The benchmark Korea Composite Stock Price Index (KOSPI) fell 2.66 points to 1,897.50, just below the 1,900-point resistance level. The last time the index ended below the line was on Feb. 5. Trading volume was moderate at 317.33 million shares worth 5.11 trillion won (US$4.64 billion), with decliners beating gainers 561 to 259.

Analysts said the decline came as investors were shaken from the economic crisis in Russia.

"News of a possible default in the Russian economy along with the continuous fall in oil prices did have an adverse effect on investors' market outlooks," said Bae Sung-young, an analyst at Hyundai Securities Co.

However, market watchers also said some of the uncertainties abroad were eased after the Federal Open Market Committee (FOMC) decided to keep the U.S. key interest rate unchanged, and that investors may have slightly overreacted to the bad news in Russia.

"The last time I checked, Russia still had enough foreign reserves to pull itself together, and as long as the plunge in oil prices doesn't persist, the economic slump will not last very long," Bae said.

South Korea's finance ministry said it was reviewing the latest FOMC meeting and keeping a close watch on developments in Russia for potential impacts on the local financial market.

Senior members of the ministry gathered for a meeting as the Russian crisis hit emerging markets hard, sending their currencies on a downward spiral as investors switched over to safer assets like the greenback.

"Policymakers exchanged views and moved to assess the latest developments," a ministry official said.

Foreigners sold a net 542.91 billion won, and retail investors offloaded a net 70.18 billion won. Institutions bought more shares than they sold at 499.5 billion won.

Tech shares closed mixed, with Samsung Electronics finishing unchanged at 1,266,000 won, while LG Electronics backtracked 1.85 percent to 58,400 won. Chipmaker SK hynix, in contrast, moved up 2.14 percent to 47,700 won.

Auto stocks also moved in different directions, as Kia Motors climbed 0.19 percent to 52,600 won while both Hyundai Motor and car parts maker Hyundai Mobis dropped 0.89 percent and 0.63 percent to close at 167,500 won and 235,000 won, respectively.

SK Telecom, the country's top mobile carrier, shed 0.36 percent to 273,000 won, and No. 3 LG Uplus also slid 0.44 percent to 11,400 won. KT added 0.16 percent to 31,550 won.

Cheil Industries closed at 113,000 won, up 6.6 percent on its debut day to satisfy market expectations.

The country's No. 1 car heater and air conditioner supplier, Halla Visteon Climate Control, advanced 1.58 percent to finish at 48,150 won after announcing that nearly 70 percent of the company would be sold to a local buyout fund and Hankook Tire Co.

The local currency ended at 1,101.50 won against the U.S. dollar, down 6.60 won from Wednesday's close.

Bond prices, which move inversely to yields, ended lower. The yield on three-year Treasurys increased 1.4 basis points to 2.183 percent, and the return on the benchmark five-year government bonds went up 2.5 basis points to 2.382 percent.

yjkim8826@yna.co.kr

(END)

-

Defense chief says N. Korea's hypersonic missile 'unsuccessful' in last-stage glide flight

Defense chief says N. Korea's hypersonic missile 'unsuccessful' in last-stage glide flight -

Relax, immerse yourself in scents at Venice Biennale's Korean Pavilion

Relax, immerse yourself in scents at Venice Biennale's Korean Pavilion -

Overdue debut of Korean abstract art pioneer Yoo Young-kuk at Venice Biennale

Overdue debut of Korean abstract art pioneer Yoo Young-kuk at Venice Biennale -

N. Korea has capability to genetically engineer biological military products: U.S. report

N. Korea has capability to genetically engineer biological military products: U.S. report -

PPP lawmaker says entire Cabinet should resign over general elections defeat

PPP lawmaker says entire Cabinet should resign over general elections defeat

-

Relax, immerse yourself in scents at Venice Biennale's Korean Pavilion

Relax, immerse yourself in scents at Venice Biennale's Korean Pavilion -

Overdue debut of Korean abstract art pioneer Yoo Young-kuk at Venice Biennale

Overdue debut of Korean abstract art pioneer Yoo Young-kuk at Venice Biennale -

Defense chief says N. Korea's hypersonic missile 'unsuccessful' in last-stage glide flight

Defense chief says N. Korea's hypersonic missile 'unsuccessful' in last-stage glide flight -

(LEAD) Yoon vows to improve communication with people after election defeat

(LEAD) Yoon vows to improve communication with people after election defeat -

Yoon presides over emergency meeting on Mideast crisis

Yoon presides over emergency meeting on Mideast crisis

-

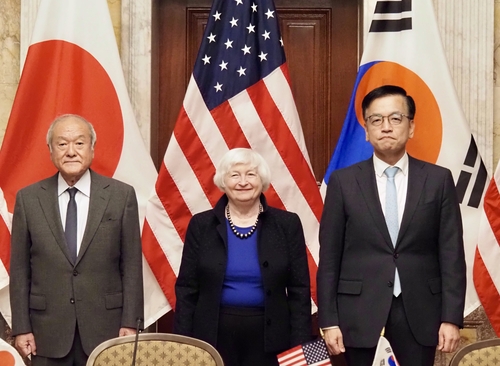

(4th LD) Finance chiefs of S. Korea, U.S., Japan recognize 'serious' concerns over 'sharp' won, yen depreciation

(4th LD) Finance chiefs of S. Korea, U.S., Japan recognize 'serious' concerns over 'sharp' won, yen depreciation -

S. Korea to provide 100,000 tons of rice to 11 nations

S. Korea to provide 100,000 tons of rice to 11 nations -

Yoon, Daegu mayor met to discuss post-election matters: sources

Yoon, Daegu mayor met to discuss post-election matters: sources -

Facebook page unveils photos of BTS member V in counter-terrorism unit gear

Facebook page unveils photos of BTS member V in counter-terrorism unit gear -

(LEAD) Yoon, Kishida agree to deepen trilateral ties with U.S.

(LEAD) Yoon, Kishida agree to deepen trilateral ties with U.S.