Seoul shares likely to maintain upward march next week

SEOUL, July 3 (Yonhap) -- South Korean stocks are expected to post a moderate gain next week, as investors will likely increase bets in local equities ahead of the central bank's rate-setting meeting and Greek woes' ebb, analysts said.

The benchmark Korea Composite Stock Price Index (KOSPI) closed at 2,104.41 on Friday, up 0.68 percent from a week earlier. The index began the week with a sharp fall as fear of Greece going into default weighed down on investor sentiment.

After Athens failed to make a repayment by the Tuesday deadline, Prime Minister Alexis Tsipras' call on voters to oppose the tougher rescue proposal by its international lenders' exacerbated market sentiment.

But the fear eased as market watchers projected the limited impact from the Greek debt crisis, citing signs of continued inflows into the local market. Also, the MERS scare has eased to some degree since its May outbreak, raising hopes for an economic rebound.

Next week, analysts said investors will likely increase bets on local shares, keeping a close eye on the Bank of Korea's policy meeting on Thursday, with a freeze on the key rate widely expected.

"The uncertainties over Greece will continue throughout the week, since the vote result, either way, entails further discussion and a long process for Athens. It's more worth noting that we've seen more funds coming in for the past two weeks despite the Greek jitters," said Koh Seung-hee, an analyst at KDB Daewoo Securities Co.

Samsung Electronics Co., the No. 1 market cap, is due to release its second-quarter earnings preview on Tuesday, which will also draw keen market attention, they added.

This week, foreigners bought more shares than they sold off at 110 billion won (US$98.1 million), while individuals unloaded a net 47 billion won and institutions dumped a net 24 billion won.

Pharmaceutical stocks were the biggest gainers of the week with a 9 percent rise, followed by medical equipment shares with 4.7 percent and chemical firms with 3.4 percent.

In contrast, banks and autos were among the decliners, each losing 2.1 percent and 1.6 percent.

elly@yna.co.kr

(END)

-

Defense chief says N. Korea's hypersonic missile 'unsuccessful' in last-stage glide flight

Defense chief says N. Korea's hypersonic missile 'unsuccessful' in last-stage glide flight -

Relax, immerse yourself in scents at Venice Biennale's Korean Pavilion

Relax, immerse yourself in scents at Venice Biennale's Korean Pavilion -

Overdue debut of Korean abstract art pioneer Yoo Young-kuk at Venice Biennale

Overdue debut of Korean abstract art pioneer Yoo Young-kuk at Venice Biennale -

N. Korea has capability to genetically engineer biological military products: U.S. report

N. Korea has capability to genetically engineer biological military products: U.S. report -

PPP lawmaker says entire Cabinet should resign over general elections defeat

PPP lawmaker says entire Cabinet should resign over general elections defeat

-

Relax, immerse yourself in scents at Venice Biennale's Korean Pavilion

Relax, immerse yourself in scents at Venice Biennale's Korean Pavilion -

Overdue debut of Korean abstract art pioneer Yoo Young-kuk at Venice Biennale

Overdue debut of Korean abstract art pioneer Yoo Young-kuk at Venice Biennale -

Defense chief says N. Korea's hypersonic missile 'unsuccessful' in last-stage glide flight

Defense chief says N. Korea's hypersonic missile 'unsuccessful' in last-stage glide flight -

(LEAD) Yoon vows to improve communication with people after election defeat

(LEAD) Yoon vows to improve communication with people after election defeat -

Yoon presides over emergency meeting on Mideast crisis

Yoon presides over emergency meeting on Mideast crisis

-

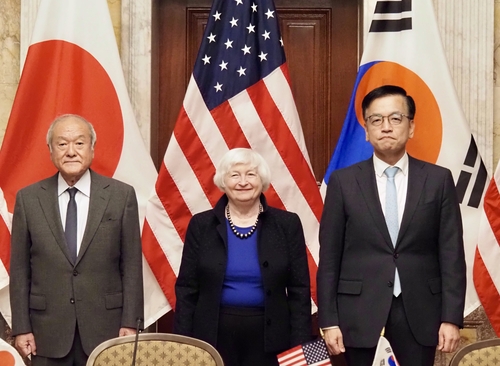

(4th LD) Finance chiefs of S. Korea, U.S., Japan recognize 'serious' concerns over 'sharp' won, yen depreciation

(4th LD) Finance chiefs of S. Korea, U.S., Japan recognize 'serious' concerns over 'sharp' won, yen depreciation -

S. Korea to provide 100,000 tons of rice to 11 nations

S. Korea to provide 100,000 tons of rice to 11 nations -

Yoon, Daegu mayor met to discuss post-election matters: sources

Yoon, Daegu mayor met to discuss post-election matters: sources -

Facebook page unveils photos of BTS member V in counter-terrorism unit gear

Facebook page unveils photos of BTS member V in counter-terrorism unit gear -

S. Korea to provide US$200 million in humanitarian aid to Ukraine this year

S. Korea to provide US$200 million in humanitarian aid to Ukraine this year