(LEAD) Seoul shares fall on reduced foreign buys, weak Chinese markets

(ATTN: ADDS bond yields at bottom; Minor edits)

SEOUL, Aug. 16 (Yonhap) -- South Korean stocks trimmed earlier gains to end flat due to reduced foreign buying and poor-performing Chinese stocks. The local currency climbed against the U.S. dollar.

The benchmark Korea Composite Stock Price Index (KOSPI) fell 2.71 points, or 0.13 percent, to 2,047.76.

The main index fell after marking a 1.61 percent increase for the whole of last week. On Friday, it closed at 2,050.47 points, hitting fresh yearly highs.

Kim Ye-eun, an analyst at LIG Investment & Securities, said the local stocks fell "as foreigners reduced their purchasing volume of local stocks and the Chinese stock market turned lower."

Foreigners cut their buying but remained net buyers of local stocks with a purchase worth 24 billion won while institutions sold a net 12 billion won on profit-taking.

The Dow Jones industrial average rose 0.32 percent, with the tech-heavy Nasdaq composite index climbing 0.56 percent.

Large-cap stocks were mixed across the board.

Market bellwether Samsung Electronics Co. rose 1.49 percent to 1,568,000 won and SK Innovation, the nation's largest refiner, gained 2.30 percent to 155,500 won.

In contrast, top automaker Hyundai Motor Co. fell 2.21 percent to 133,000 won, and top auto parts maker Hyundai Mobis Co. declined 0.77 percent to 258,000 won.

The local currency closed at 1,092.20 won against the U.S. dollar, up 11.10 won from the previous session's close.

Bond prices, which move inversely to yields, closed higher. The yield on three-year Treasurys fell 1.1 basis points to 1.219 percent and the return on the benchmark five-year government bond lost 1.2 basis points at 1.243 percent.

entropy@yna.co.kr

(END)

-

N. Korea slams U.S. subcritical nuclear test, vows measures to bolster nuclear deterrence

N. Korea slams U.S. subcritical nuclear test, vows measures to bolster nuclear deterrence -

Thailand seeks extradition of S. Korean suspect in Pattaya murder

Thailand seeks extradition of S. Korean suspect in Pattaya murder -

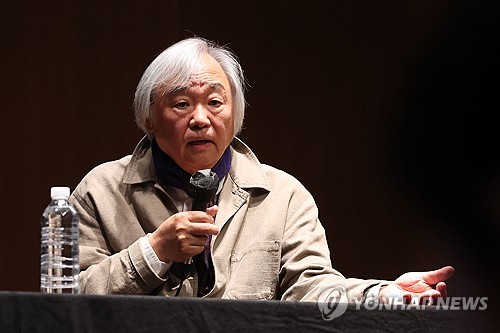

Paik Kun-woo's 1st Mozart album: a return to musical roots

Paik Kun-woo's 1st Mozart album: a return to musical roots -

N. Korea's Kim, daughter attend ceremony for new street in Pyongyang

N. Korea's Kim, daughter attend ceremony for new street in Pyongyang -

(2nd LD) N. Korea says it test-fired tactical ballistic missile with new guidance technology

(2nd LD) N. Korea says it test-fired tactical ballistic missile with new guidance technology

-

Paik Kun-woo's 1st Mozart album: a return to musical roots

Paik Kun-woo's 1st Mozart album: a return to musical roots -

N.K leader visits newly built ruling party training school

N.K leader visits newly built ruling party training school -

N. Korea's Kim, daughter attend ceremony for new street in Pyongyang

N. Korea's Kim, daughter attend ceremony for new street in Pyongyang -

(Yonhap Feature) S. Korean women scramble for 'safe breakup' after series of femicides by ex-boyfriends

(Yonhap Feature) S. Korean women scramble for 'safe breakup' after series of femicides by ex-boyfriends -

(LEAD) Unification minister criticizes ex-liberal President Moon's memoir

(LEAD) Unification minister criticizes ex-liberal President Moon's memoir

-

N. Korea slams U.S. subcritical nuclear test, vows measures to bolster nuclear deterrence

N. Korea slams U.S. subcritical nuclear test, vows measures to bolster nuclear deterrence -

Police to question Hybe officials over complaint against sublabel executives

Police to question Hybe officials over complaint against sublabel executives -

Top S. Korean, U.S., Japanese, Australian Army officials discuss deterrence against N.K. threats

Top S. Korean, U.S., Japanese, Australian Army officials discuss deterrence against N.K. threats -

(LEAD) S. Korea, U.S. hold 2nd round of talks on defense cost sharing

(LEAD) S. Korea, U.S. hold 2nd round of talks on defense cost sharing -

Russian delegation arrives in Pyongyang: KCNA

Russian delegation arrives in Pyongyang: KCNA