Regulator begins review of suspected accounting breaches at Samsung BioLogics

SEOUL, May 17 (Yonhap) -- The financial authorities and Samsung BioLogics Co. on Thursday held their first session reviewing a regulatory probe into the biotechnology firm over suspected accounting breaches, officials said.

The biotech arm of Samsung Electronics Co., the world's largest chip and smartphone manufacturer, has lost nearly a third of its market capitalization since financial authorities notified the company of an accounting violation on May 1. Samsung Biologics has strongly denied it breached any accounting rules.

The meeting is also aimed at offering Samsung BioLogics a chance to defend its stance on the regulatory probe, officials said.

A final confirmation of the regulatory probe will be made at a regular meeting, set for early next month, of the Securities and Futures Commission, a sub-commission within the Financial Services Commission (FSC), and which is responsible for the oversight of the securities and futures markets.

No further details of the Thursday session were provided because participants signed confidentiality agreements, FSC officials said.

The probe centeres on questions about Samsung BioLogics' sudden profit in 2015.

Founded in 2011 as a new growth engine of Samsung Group, Samsung BioLogics posted losses until 2014.

In 2015, however, the company posted a net profit of 1.9 trillion won (US$1.76 billion) after it changed the method used to calculate the value of its affiliate, Samsung Bioepis.

Samsung BioLogics has claimed that the change was in line with international accounting standards.

Before Samsung BioLogics went public in 2016, Samsung Electronics and Cheil Industries Inc. each owned 40 percent stakes in the biosimilar maker.

People's Solidarity for Participatory Democracy, an influential civic group, has argued that Samsung BioLogics may have inflated its profit to raise the value of the company to benefit Samsung Group's heir apparent Lee Jae-yong, who held a major stake in Cheil Industries at that time.

The civic group has said the suspected accounting breaches at Samsung BioLogics may have helped the controversial takeover of Samsung C&T Corp. by Cheil Industries Inc. in 2015.

The merger of two Samsung units was widely seen as a step to enhance Lee's control of Samsung Group as his father Lee Kun-hee suffered a heart attack in 2014 and has been hospitalized ever since.

kdh@yna.co.kr

(END)

-

N. Korea slams U.S. subcritical nuclear test, vows measures to bolster nuclear deterrence

N. Korea slams U.S. subcritical nuclear test, vows measures to bolster nuclear deterrence -

Thailand seeks extradition of S. Korean suspect in Pattaya murder

Thailand seeks extradition of S. Korean suspect in Pattaya murder -

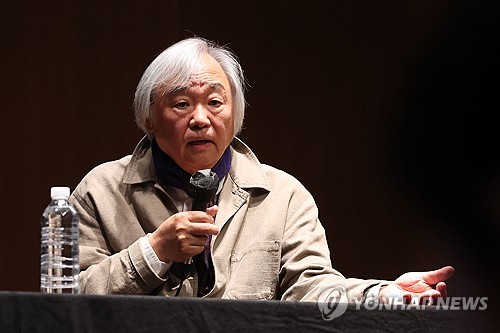

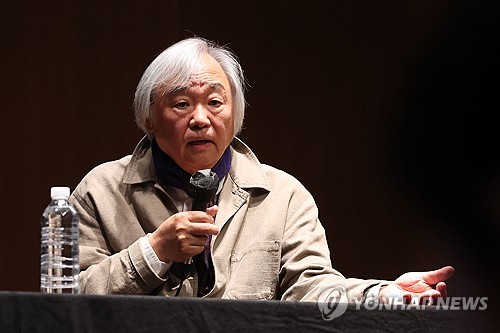

Paik Kun-woo's 1st Mozart album: a return to musical roots

Paik Kun-woo's 1st Mozart album: a return to musical roots -

N. Korea's Kim, daughter attend ceremony for new street in Pyongyang

N. Korea's Kim, daughter attend ceremony for new street in Pyongyang -

(2nd LD) N. Korea says it test-fired tactical ballistic missile with new guidance technology

(2nd LD) N. Korea says it test-fired tactical ballistic missile with new guidance technology

-

Paik Kun-woo's 1st Mozart album: a return to musical roots

Paik Kun-woo's 1st Mozart album: a return to musical roots -

N.K leader visits newly built ruling party training school

N.K leader visits newly built ruling party training school -

N. Korea's Kim, daughter attend ceremony for new street in Pyongyang

N. Korea's Kim, daughter attend ceremony for new street in Pyongyang -

(Yonhap Feature) S. Korean women scramble for 'safe breakup' after series of femicides by ex-boyfriends

(Yonhap Feature) S. Korean women scramble for 'safe breakup' after series of femicides by ex-boyfriends -

(LEAD) Unification minister criticizes ex-liberal President Moon's memoir

(LEAD) Unification minister criticizes ex-liberal President Moon's memoir

-

N. Korea slams U.S. subcritical nuclear test, vows measures to bolster nuclear deterrence

N. Korea slams U.S. subcritical nuclear test, vows measures to bolster nuclear deterrence -

Police to question Hybe officials over complaint against sublabel executives

Police to question Hybe officials over complaint against sublabel executives -

Top S. Korean, U.S., Japanese, Australian Army officials discuss deterrence against N.K. threats

Top S. Korean, U.S., Japanese, Australian Army officials discuss deterrence against N.K. threats -

(LEAD) S. Korea, U.S. hold 2nd round of talks on defense cost sharing

(LEAD) S. Korea, U.S. hold 2nd round of talks on defense cost sharing -

Russian delegation arrives in Pyongyang: KCNA

Russian delegation arrives in Pyongyang: KCNA